*ST Oceanwide (SZ000046, share price 0.38 yuan, market value 1.975 billion yuan) is about to terminate its listing.

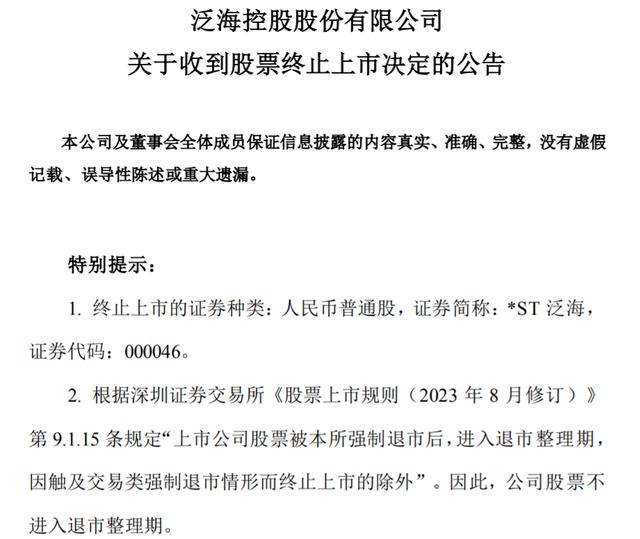

On the evening of January 26th, *ST Oceanwide announced that it had received the Decision of Shenzhen Stock Exchange (hereinafter referred to as Shenzhen Stock Exchange) on the Termination of Listing of Oceanwide Holdings Co., Ltd. (SZSE [2024] No.76), and Shenzhen Stock Exchange decided to terminate the listing of the company’s shares.

According to the Shenzhen Stock Exchange, the daily closing price of *ST Oceanwide shares was lower than that of 1 yuan for 20 consecutive trading days from November 30, 2023 to December 27, 2023, which touched the termination of listing as stipulated in Item (4) of Paragraph 1 of Article 9.2.1 of the Stock Listing Rules (revised in August 2023) of the Shenzhen Stock Exchange. "According to Article 9.2.5 of the Stock Listing Rules (revised in August 2023) of Shenzhen Stock Exchange and the deliberation opinions of the Listing Review Committee of Shenzhen Stock Exchange, this Exchange has decided to terminate the listing of your company’s shares."

At the same time, according to the provisions of Article 9.1.15 and Article 9.6.10, paragraph 2 of the Stock Listing Rules (revised in August 2023) of Shenzhen Stock Exchange, *ST Oceanwide was decided by Shenzhen Stock Exchange to terminate its listing due to the forced delisting of transactions, and will not enter the delisting consolidation period. *ST Oceanwide will be delisted within 15 trading days after Shenzhen Stock Exchange makes the decision to terminate its listing.

*ST Oceanwide said that after the company’s shares are terminated, according to the Stock Listing Rules (revised in August 2023) of Shenzhen Stock Exchange and the Implementation Measures for delisting companies to enter the delisting sector, the company’s shares will be transferred to the delisting sector managed by the National Stock Transfer Company for listing and transfer. The company has hired Shanxi Securities Co., Ltd. to provide share transfer services for the company after the company’s shares are terminated.

On January 23, *ST Oceanwide announced that it hired Shanxi Securities Co., Ltd. as the company’s lead broker, and agreed to sign the Entrusted Stock Transfer Agreement with it, entrusting it to provide share transfer services for the company, and handle the stock withdrawal registration in the market registration and settlement system of the stock exchange, the stock reconfirmation and the share registration and settlement of the national small and medium-sized enterprise share transfer system.

According to the relevant provisions of the Listing Rules of Shenzhen Stock Exchange, a company that is forced to delist its shares shall sign relevant agreements with the sponsoring brokers that meet the prescribed conditions before delisting.

At the same time, the debt problem of *ST Oceanwide is still fermenting.

According to the announcement of *ST Oceanwide on January 23, the company was informed on January 22 that Tianjin Pilot Free Trade Zone Branch of China Bohai Bank Co., Ltd. (hereinafter referred to as Bohai Bank) was on the grounds of financial loan contract disputes. China Pan Group Co., Ltd. (hereinafter referred to as China Pan Group), *ST Oceanwide, the controlling shareholder of the company, China Oceanwide Holding Group Co., Ltd., Tonghai Holding Co., Ltd. (the controlling shareholder of China Oceanwide Holding Group Co., Ltd.), Beijing Taobo Management Consulting Co., Ltd. and Oceanwide Industrial Co., Ltd. were sued to Tianjin No.3 Intermediate People’s Court. At the same time, Bohai Bank filed an application for property preservation with the court, and Tianjin No.3 Intermediate People’s Court ruled to freeze the above applications.

The cause of the case is that in November 2018, Zhongpan Group, a wholly-owned subsidiary of *ST Oceanwide, applied to Bohai Bank for financing of no more than 2 billion yuan. China Pan Group shall repay the remaining outstanding principal and interest of the above financing on November 14, 2023. As of January 23, the disclosure date of the announcement, China Pan Group has not completed the repayment of the remaining principal and interest of the above debts.

national business daily