"How cold is it this winter?"

For this problem that everyone is very concerned about

On the afternoon of November 4

China Meteorological Bureau responded.

On the afternoon of November 4th, China Meteorological Bureau held a press conference, and Jia Xiaolong, deputy director of the National Climate Center, introduced that according to the opinions of the consultation, the cold air in China is relatively frequent this winter, and the force is relatively strong, and there may be a large-scale low-temperature rain and snow weather process in the north.

Midwinter season

Low temperature rain and snow weather in the north or in a large range now

Jia Xiaolong said that the cold air affecting China this winter is still relatively frequent, and the forces are generally strong. The cold air path is mainly northwest.

Under this situation, the temperature in most parts of China is normal to low this winter, and the precipitation is generally more in the north and less in the south. The temperature changes obviously in stages. In the early winter, the temperature in most areas is normal to high, and the influence of cold air on China will become stronger in the midwinter season (around January next year). The temperature in most parts of central and eastern China may be lower than normal, and there may be a large-scale low-temperature rain and snow weather process in the north, and a large-scale and sustained low-temperature rain, snow and freezing disaster in the south is less likely.

This winter, cold air activities are frequent and the temperature fluctuates greatly, so it is necessary to guard against the adverse effects on the epidemic prevention and control work in COVID-19.

This winter will form a

Weak to moderate intensity La Nina events

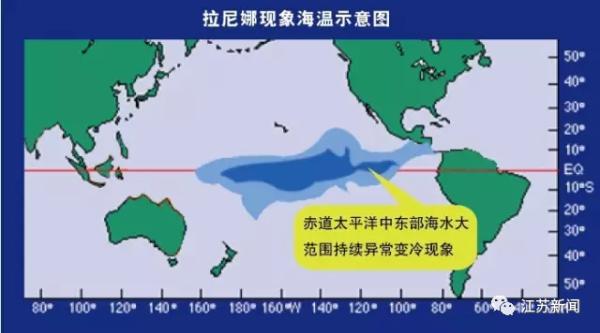

At present, the SST in the equatorial Middle East Pacific has entered the La Ni? a state, and it is expected that a weak to moderate intensity La Ni? a event will form in winter, and its later evolution trend and climate impact are still uncertain.

At the same time, in view of the complexity of the factors affecting China’s climate, and the recent increase in climate volatility, the National Climate Center will closely monitor weather and climate changes, strengthen analysis and research, and provide timely rolling revised climate forecasts.

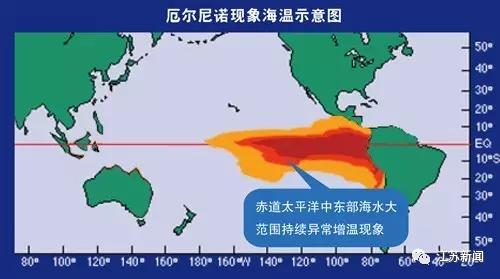

What is La Nina?

La Nina event refers to the cold water phenomenon in which the sea surface temperature in the equatorial central and eastern Pacific Ocean is abnormally cold in a large range, and its intensity and duration reach certain conditions.

When the sea temperature is unusually warm, the El Nino phenomenon will be formed. When the sea surface temperature changes, it will have a great impact on the atmospheric circulation and the climate will also change.

"Will Nanchang cool down in the near future?"

The weather in Nanchang is crisp in autumn these days.

The daytime temperature swept away the previous downturn.

Under the heating effect of sunlight

The temperature has soared.

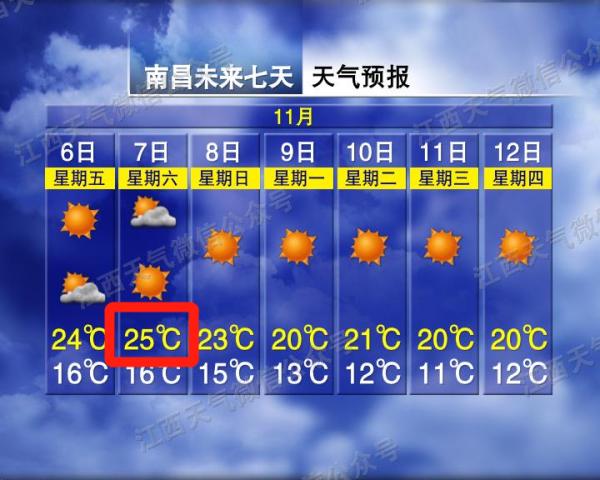

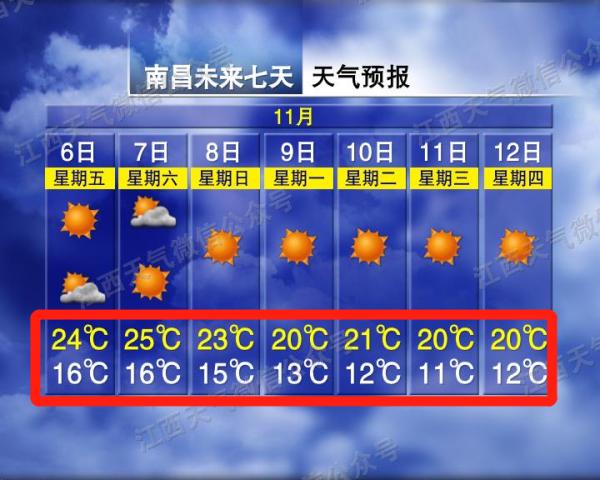

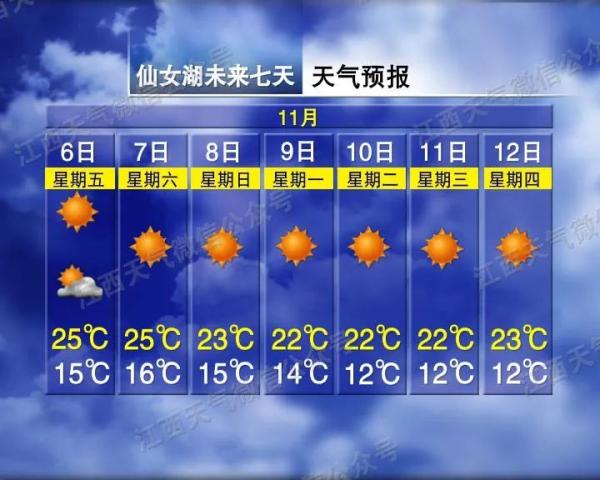

The highest temperature the day after tomorrow will reach 25℃

It’s all sunny, sunny, sunny.

Sunny sunny sunny sunny sunny sunny sunny sunny sunny sunny sunny sunny sunny sunny sunny sunny sunny sunny sunny.

Sunny sunny sunny sunny sunny sunny sunny sunny sunny sunny!

The sun is solid and the temperature is not low.

Let alone how comfortable the afternoon sunshine is.

It is expected that tomorrow and the day after tomorrow

The province’s "Xiaoqing Song" continues to sing.

Suitable for outdoor activities

It is also suitable for washing and drying.

however

There’s always one in the weather forecast

Nanchang weather is harder to guess than a woman’s mind.

Will not miss a chance to torture you.

Warning!

The temperature in Nanchang is going to "change face" again.

Are you ready?

Xiaobian is going to start reporting the weather

Cold air quietly came to the south. The lowest temperature in Chang is 11℃

On the 8 th, the north was affected by weak cold air on the ground.

The southern part is affected by the peripheral cloud system of tropical cyclones.

Cloudy and cloudy days in the whole province

There is sporadic light rain in parts of southern Jiangxi.

The process is cooled by 3 ~ 5℃

The northerly wind is increasing

The gusts in rivers and lakes and plain valleys are 6.

The highest temperature in Nanchang on the 7 th is 25 C.

The lowest temperature on the 8th was only 15℃.

By the 11th, the lowest temperature will drop to 11℃.

It is important to pay special attention to

The temperature difference between day and night is relatively large!

See?

The temperature difference is basically around 10℃!

Everyone should pay attention to timely increase or decrease clothing.

Especially the elderly, children and people with weak constitution.

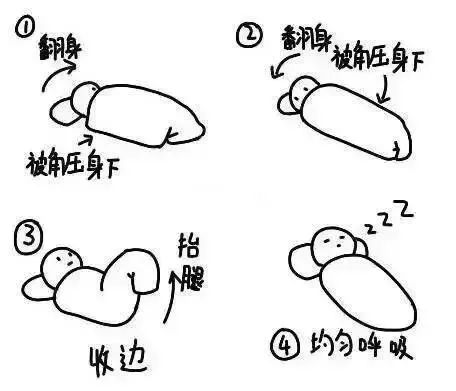

Learn about the onion dressing method ~

Let’s take a look

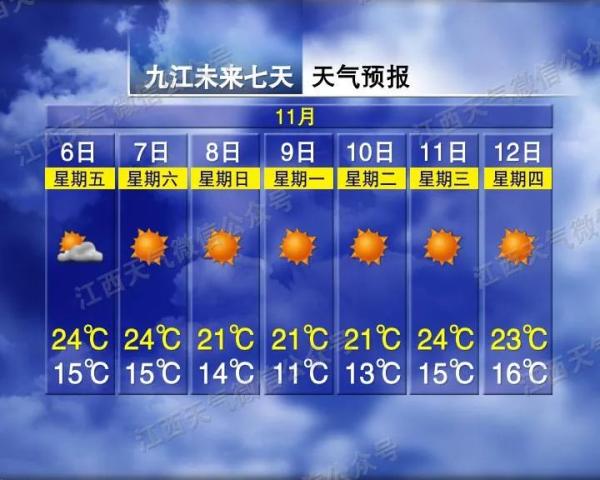

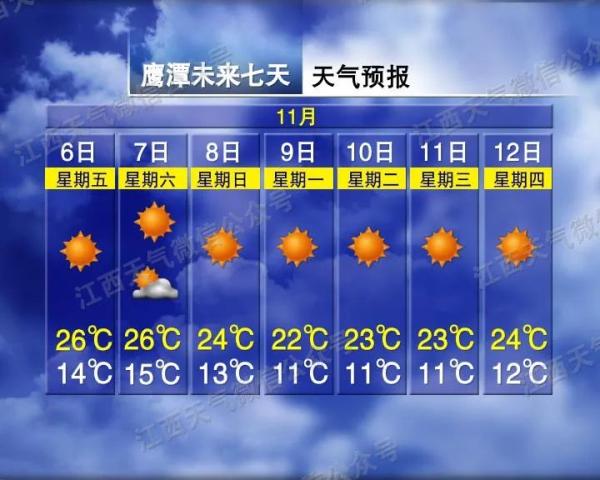

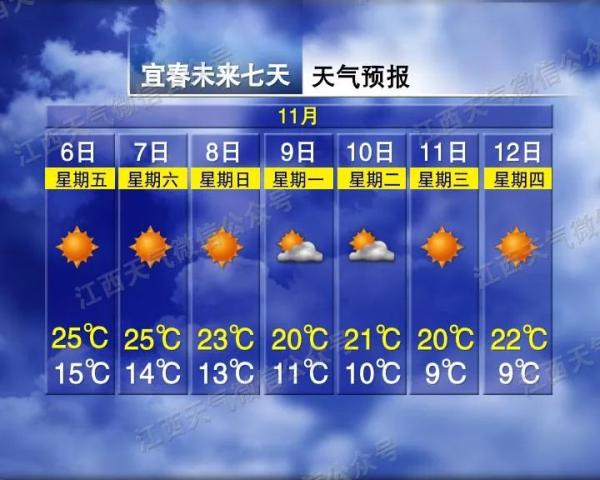

The province’s specific weather forecast!

Specific forecast

It will be cloudy and sunny in the whole province tomorrow and the day after tomorrow.

On the 8 th, it was cloudy and cloudy in the province, and there was sporadic light rain in southern Jiangxi; During the process, the temperature dropped by 3 ~ 5℃, the northerly wind increased, and the gusts in rivers and lakes and plain valleys were 6.

From September 9 to 15, the province was dominated by sunny and cloudy weather.

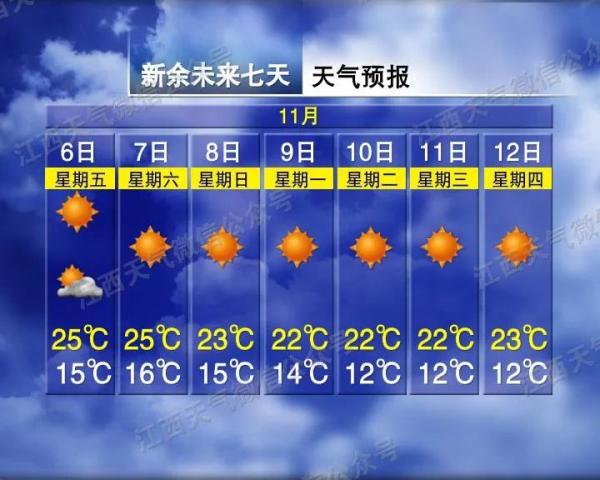

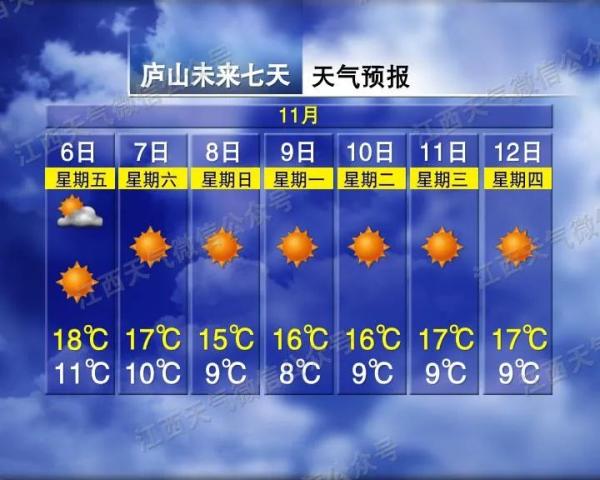

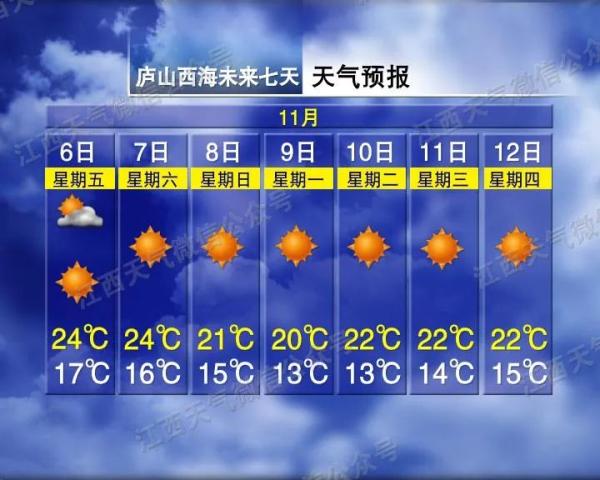

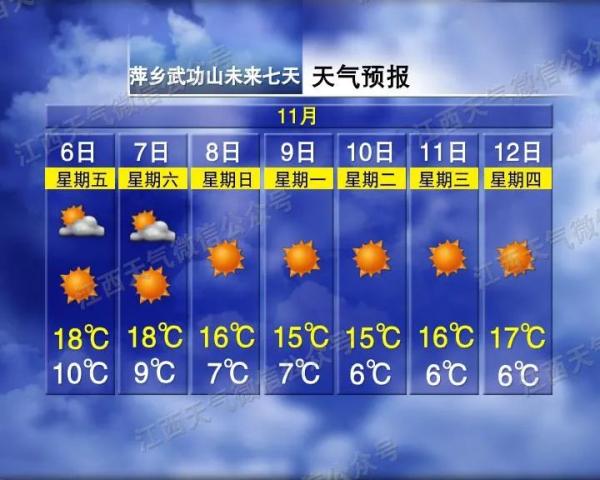

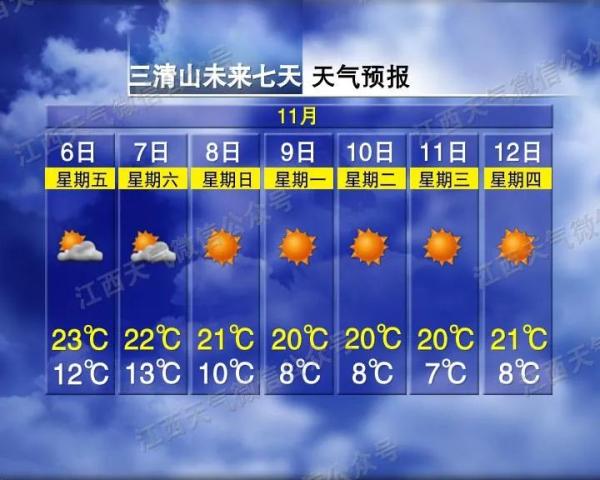

Seven-day forecast of other major cities and scenic spots in Jiangxi Province

Swipe up to view

The weather is getting cold

So every day you

They have become "difficult households" who get up.

▽

You sleep at night

When you cover the quilt, it becomes like this.

▽

Of course, this is nothing.

What is even more cruel is that

↓↓↓

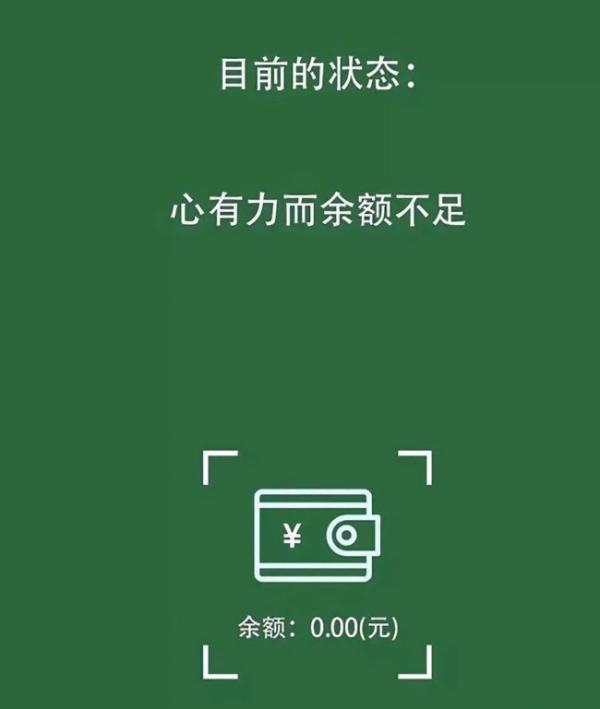

The money is gone

The annual double 11 has begun to pay the final payment.

By the way, what have you hoarded?

Is the following scene a true portrayal of you

I’ll join the shopping cart and not buy it.

I really can’t hold back behind.

Finally, Xiaobian reminds everyone again.

Get up early and move bricks, remember to add clothes in time.

Keep warm

Migrant workers who paid the final payment

Come on, Ollie. Here!

Disclaimer: This article is reproduced for the purpose of transmitting more information. If the source is marked incorrectly or infringes on your legitimate rights and interests, please contact this website with the ownership certificate, and we will correct and delete it in time. Thank you.

Source: Nanchang News