Recently, the advertisement card in the live broadcast room of "Fashion Festival" in Li Jiaqi appeared on the homepage of bilibili mobile APP.

After clicking this card, you will jump directly from bilibili to Li Jiaqi Live Room in Taobao, and the "Newcomer Limited Time Subsidy" product will automatically appear at the bottom of the Live Room page. After closing the pop-up window, you will jump out to the page of receiving new guest red envelopes.

Taobao said that at present, many UP owners have brought goods for Taobao through live broadcast, that is, the UP owners broadcast in bilibili, reaching Taobao to place orders with one click.

This is behind bilibili’s "big open loop" strategy in e-commerce business. Under this strategy, bilibili opened a commodity library with the head e-commerce platform through one-click switching and advertising space, and conducted in-depth cooperation in a more targeted manner. After that, bilibili will connect the whole ecology to various e-commerce platforms and brands.

|Commercialization in bilibili began to make money.

There is no gratuitous gift in business. bilibili sells the traffic to Taobao Live, mainly to increase his advertising revenue and continuously strengthen his commercialization ability. Commercialization is the top priority in bilibili in recent years, especially the business income related to e-commerce. The reason for this is the following:

On the one hand, advertising, live broadcast and e-commerce have brought considerable financial returns to bilibili. In 2023, bilibili achieved positive cash flow for the whole year.

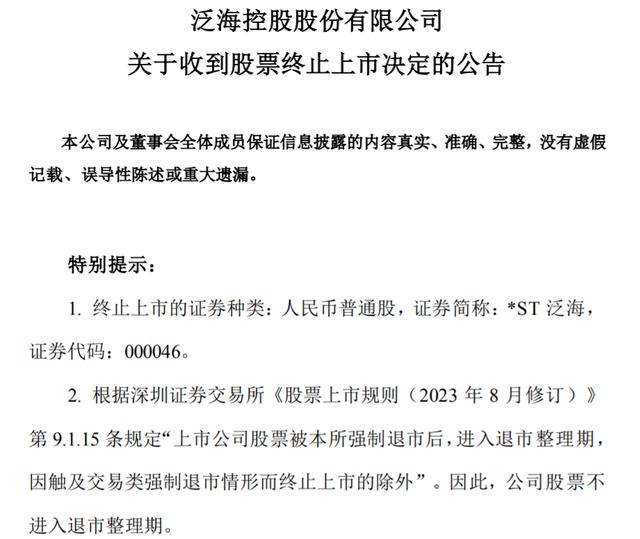

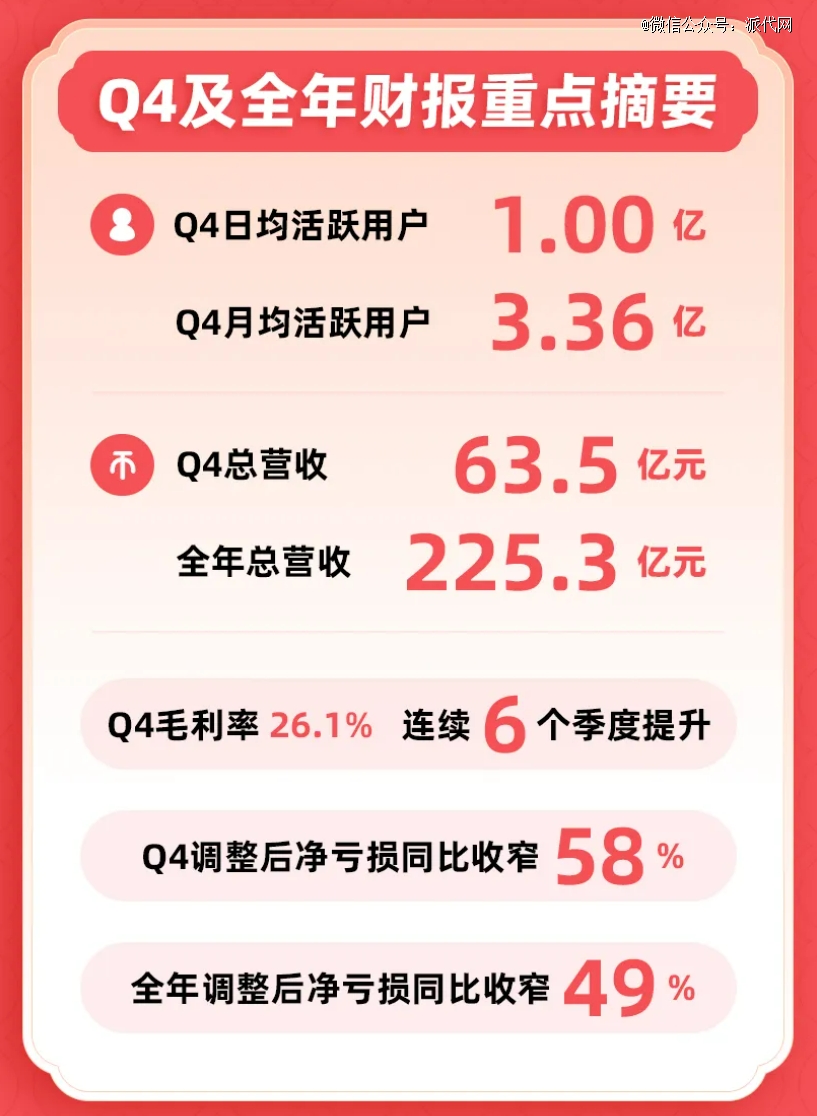

The financial report shows that in 2023, the total revenue of bilibili reached 22.53 billion yuan, a year-on-year increase of 3%; Gross profit was 5.4 billion yuan, a year-on-year increase of 41%. From the business sector, advertising and value-added services (mainly live broadcast) are the main driving forces for bilibili’s revenue growth.

Source: bilibili official WeChat WeChat official account

Source: bilibili official WeChat WeChat official account

Specifically, in 2023, bilibili’s advertising revenue was 6.41 billion yuan, a year-on-year increase of 27%; Revenue from value-added services (live broadcast and big membership) reached 9.91 billion yuan, up 14% year-on-year.

On the other hand, the core income has been weak before, including games, IP derivatives and other businesses.It can be seen from the financial report that the revenue of several new games was lower than expected, which dragged down the annual revenue growth rate of bilibili in 2023. Bilibili’s game business revenue in 2023 was 4.02 billion yuan, down nearly 5% year-on-year, which exceeded market expectations.

The management of bilibili said that it is confident that the operating profit will turn positive after adjustment in 2024Q3, and it will be profitable. In order to achieve this goal,The "big open loop" strategy of cooperation between bilibili and e-commerce platform has become the key development direction..

The so-called "open-loop" strategy refers to opening bilibili’s content ecology to Pinduoduo, Taobao, JD.COM and other head e-commerce platforms for diversion, and exporting content-based transaction traffic outside the station to replace the closed-loop business path of planting grass and trading in the station.

In the third quarter of 2022, bilibili launched a "big open loop" strategy to direct traffic to e-commerce platforms such as JD.COM and Taobao, so as to make up for the shortcomings in the business chain of e-commerce. Less than a year after the implementation of the "Great Open-loop Strategy", bilibili has opened relevant links with Taobao, JD.COM and Pinduoduo. Among them, by the second quarter of 2023, the cooperation between bilibili and Taobao accounted for 70% of the e-commerce business volume of bilibili Great Open Loop.

According to LatePost, in April 2023, Daishan, president of Taotian Group, led a delegation to visit bilibili to discuss cooperation, and finally decided to increase the amount of advertising in bilibili, more than five times the original amount.

Not only Ali, Pinduoduo and JD.COM are regular customers of bilibili. During the "June 18th Promotion" in 2023, bilibili’s advertising revenue from Ali, JD.COM, Pinduoduo and other e-commerce industries increased by over 200% year-on-year. In addition, some insiders said that Pinduoduo’s ROI in bilibili was at least greater than 5. According to public information, the ROI of some well-known consumer brands can also reach 2-2.5.

Behind the "big-handed" launch of e-commerce platforms such as Ali, Pinduoduo and JD.COM, they took a fancy to the highly sticky young users in bilibili.The data shows that the average age of users in bilibili is about 24 years old, among which the coverage rate of Z+ generation users reaches 65%, and more than half of users live in second-tier cities and above, with a ratio of male to female close to 1: 1.

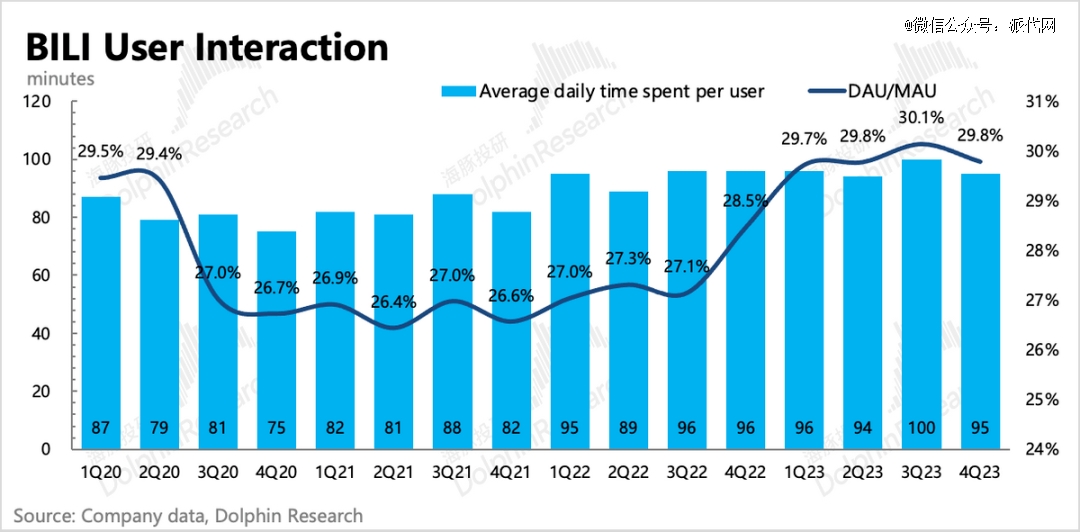

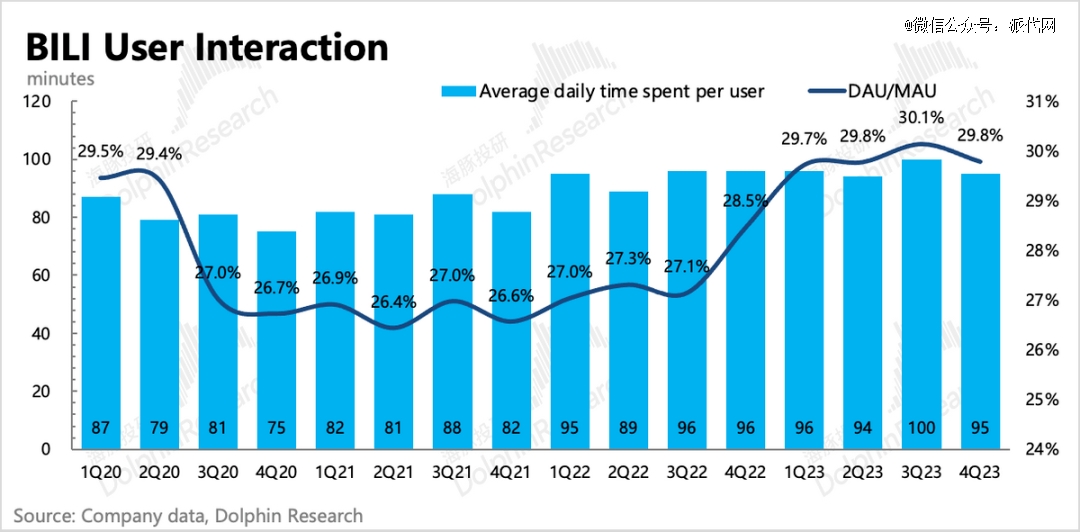

With the daily average active users stable at the order of 100 million, bilibili has become the mainstream video content platform in China. Its daily average user duration has reached 96.25 minutes.

Source: Dolphin Investment Research

Source: Dolphin Investment Research

However, regarding the traffic trafficking in bilibili, some insiders said that this is not a long-term behavior. Bilibili, as the content platform of the large-scale open-loop e-commerce at present, can get a share of the e-commerce market quickly under this mode, but it only plays the role of a channel and "hands over" its own traffic. The same is the content platform, and Xiaohongshu is developing in the direction of closed-loop e-commerce.

| bilibili e-commerce is constantly moving

At present, bilibili’s e-commerce is developing in two major directions. One is to cooperate with other e-commerce platforms to open a "big open loop" strategy; The second is to support the UP main live broadcast in the station.

In cooperation with other e-commerce platforms,In 2018, long before the strategy of "big open-loop e-commerce" was put forward, bilibili and Taobao Alliance reached an all-round cooperation. Both parties supported UP owners to establish Taobao Daren accounts. Through personalized recommendation, content operation and other forms, both parties jointly provided traffic support, allowing UP owners to commercialize by directly bringing goods and docking business orders.

In the third quarter of 2022, bilibili officially implemented the strategy of "big open-loop e-commerce", and opened the advertising cooperation in the station for e-commerce advertisers such as Ali, JD.COM and Pinduoduo. Among them, bilibili took the lead in reaching a cooperation with Ali, and started the Spark Program. From the follow-up effect, the proportion of new customers led by the program from bilibili to Taobao stores was 70%.

At the same time, during the double 11 last year, the original "Member Purchase" entrance at the bottom of the mobile phone App in bilibili was temporarily renamed as "double 11", and a new "Tmall double 11" section was added to directly display Tmall products and support clicking and jumping to the Tmall page to purchase, providing users with more convenient consumption scenarios.

Besides Ali, bilibili also cooperates with platforms such as JD.COM and Pinduoduo. In 2024, bilibili will continue to deepen the cooperation of UP owners, and the number of UP owners cooperating with Pinduoduo is expected to increase by more than 100% year-on-year. Because of his generous hand, Pinduoduo was dubbed by netizens as "the gold owner of bilibili *" and "supported half of the UP owners in the station by himself".

In addition to the three mainstream e-commerce platforms, many cutting-edge consumer brands are also increasing their layout in bilibili. For example, in October, 2023, Wujiang mustard tuber launched two new products jointly with bilibili (Wujiang mustard tuber mass-selling package sold online and 70g regular package sold offline), which brought real sales growth. According to the data, in Tmall Wujiang official flagship store, the joint new products were sold for 24 hours, ranking in the top 5 in sales. As of October 24, 2023, the cumulative transaction amount of Tik Tok joint special event exceeded 630,000.

It is worth noting that behind bilibili’s "big open loop" strategy, the road of self-operated e-commerce is impassable. Bilibili has tried to expand the variety of goods supply based on the existing "member purchase" system, but the effect is not good. Li Xi, COO of bilibili, thinks that e-commerce is a large-scale business, and it needs to accumulate transaction-related technologies, while bilibili does not have either for the time being.

On the UP main live broadcast cargo in the support stationNowadays, live broadcast with goods has become a breakthrough in bilibili’s e-commerce business. Bilibili COO Li Xi introduced that in the fourth quarter of the e-commerce peak season in 2023, bilibili had an average of more than 60,000 UP owners participating in the delivery business every day. Among them, during the Double Eleven period, the GMV of omni-channel delivery exceeded 1.6 billion yuan, and the single transaction GMV of female clothing UP parrot pear with live delivery in December exceeded 50 million yuan.

However, there are also UP owners who encounter "Waterloo" on live delivery. For example, in June 2023, the head UP owner "Brother Daxiang is coming" with 5 million fans, after the announcement of live broadcast with goods, caused fans to boycott, and was spit out by fans as "down and out" and "just bad money". After the live broadcast, the powder dropped more than 170,000. At present, "Daxiangge" has stopped the live broadcast of goods.

But bilibili live broadcast has just started, and there is still a long way to go in the future. In addition, it should be noted that bilibili’s choice of "open-loop" e-commerce mode means that it relies heavily on external platforms and it is difficult to form a competitive advantage.

Some insiders have commented that bilibili can’t master the whole process of users from planting grass to trading. At the same time, logistics and after-sales in bilibili also depend on external platforms, which undoubtedly increases the operational risk of brands or businesses.

|Where are the opportunities for businesses?

Li Xi said: "The core competitiveness of bilibili is the platform with the highest density of young people in China. The average age of these young people is 24 years old, and they are all at the age of leaving school and are in the rising range of consumption. Therefore, bilibili is now a necessary platform for brands to establish consumer minds. Whether it is short-term transaction transformation or long-term consumer minds, they will choose bilibili. "

Consistent with Li Xi’s statement,Compared with other e-commerce platforms, bilibili has a high-stickiness, younger user group, which has the characteristics of long time and long video acceptance. In addition, due to the user tonality and strong community atmosphere of the original strategy gathering in bilibili, the UP main ecology is prosperous.

The above-mentioned fan characteristics also determine that the UP main live broadcast has a strong private domain attribute. As mentioned above, it is said that your own delivery is actually a kind of group purchase delivery based on private domain.

It focuses on the decoration of popular science, home and other content, through "it takes 30W to measure the water purifier, and the result is not as good as boiling water?" "What’s the difference between the collection ability of washing and drying?" Wait for a series of videos to gain fans. And he also started live broadcast with goods in line with the commercialization trend in bilibili. During the Double Eleven in 2023, the total amount of omni-channel payment was as high as 1.68 billion, with a year-on-year growth rate of 400%. One person’s record is almost half that of GMV.

"The case of staring has been verified.Consumer-resistant products such as home and digital, combined with bilibili’s relatively long video content,, including the mode of in-depth evaluation, is our advantage of carrying goods. "Li Wei said.

In addition, in recent years, the content influence of living quarters and entertainment areas in bilibili has increased the stickiness of young female users. For example, recently, the fashion category UP main "Parrot Pear" brought 50 million yuan of goods in a single live broadcast, and 90% of the ordering users were women.

It can be seen that bilibili e-commerce has the above advantages in developing business. Now, with the cooperation with Taobao again, the advertising card has jumped into the live broadcast room of Taobao, which means that bilibili has taken a key step and is accelerating its commercialization, which has brought three major impacts.

First, it saves capital investment and increases its own advertising commission income. Last year, the "Member Purchase" entrance at the bottom of the mobile phone APP in double 11 and bilibili was temporarily renamed as "double 11", and a new "Tmall double 11" section was added to display products and support direct jumping. According to statistics, the advertising flow from the head e-commerce platform in double 11 and bilibili increased by over 80% last year.

The second is to undertake the commodity library of the e-commerce platform and access the mature shelves. The cooperation with Taobao Live means that bilibili will fully spread the open-loop e-commerce model, and through this unique mode of bringing goods, bilibili users will continue to refresh their cognition, and finally help the platform to successfully achieve high-conversion delivery.

The third is to promote the platform to create a more mature live broadcast e-commerce ecosystem, further enhance the platform’s own live broadcast and delivery atmosphere, and attract more UP owners to carry out live broadcast and delivery for a long time.

In addition, it should be noted that since bilibili adopts a "big open loop" e-commerce, the essence of which is output traffic, if other e-commerce platforms do not provide good service, it may bring itself back and lead to the loss of users.

Zhuang Shuai, founder of Bailian Consulting, publicly stated that to fundamentally solve the problem, it is necessary to build a supply chain and e-commerce operation system like "closed-loop e-commerce". But … Zhuang Shuai also mentioned that "if the open-loop model has a user scale, it can be done for a long time, and the closed-loop e-commerce needs daily life and cash to support it."

Generally speaking, bilibili is making every effort to develop its e-commerce business, and seriously considering the matter of "just meals", which also brings new opportunities to the e-commerce industry, especially for consumer-resistant products such as home and digital products. However, the e-commerce in bilibili started late, and the form of goods delivery has only taken shape, and the e-commerce mind is still immature, which still needs more exploration.

In addition, because the e-commerce mentality of users has not been cultivated, bilibili needs to balance the development of content and e-commerce in the process of e-commerce.

References:

1. "Bonuses, Difficulties and Possible Solutions of Goods Carried in bilibili". Narrow broadcast.

2. With an annual income of 22.5 billion yuan, bilibili’s boss works hard to bring goods. 21st century business herald

3, "bilibili Struggles to Stand Up". Tiger Sniff

4. How did bilibili become the "advertising department" of Pinduoduo? ".Yuanchuan Institute

Source: bilibili official WeChat WeChat official account

Source: bilibili official WeChat WeChat official account Source: Dolphin Investment Research

Source: Dolphin Investment Research